The world has endured a much worse pandemic then Covid-19. The Spanish flu of 1918 was highly contagious and spread globally, killing more then 50 million worldwide (mostly between the ages of 20 to 40 years old).

While its still early days for Covid-19, positive news is coming out of China and South Korea who seem to be getting the situation under control (Hubei province reported no new cases for the first time today).

After seeing Italy come to its knees, Governments around the world have understood the seriousness of the matter and have began taking appropriate measures.

While the next few weeks/months is critical to see how this plays out, based on the above, I am optimistic, we will recover from Covid-19.

Impact to the Economy and the Stock Markets

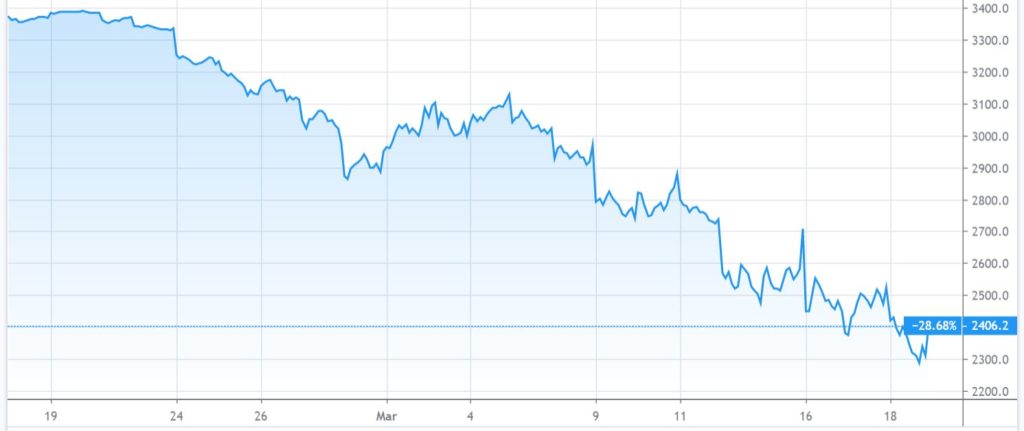

The stock markets have taken a beating with the S&P 500 down about 25% over the past month. This isn’t surprising because if most of us are staying at home, then consumption and therefore GDP will slow down.

The most important thing for the economy is to keep the debt machine going and and allow easy access to credit.

Companies borrow money with the expectation that their business will generate predictable cash flows to pay the interest and capital repayments on the loan. As a result of low interest rates during the past decade, companies have leaned more heavily on debt to finance both short term (working capital expenditures) and long-term (capital investments) investments.

Now that the economy is drastically and unexpectedly coming to a halt, those once predictable cash flows expected by businesses are drying up fast. And this poses the biggest risk to the economy.

With declining revenues, companies may have to slash operating costs, lay-off workers and fight to remain solvent (not declare bankruptcy). Some businesses will have cash reserves to fund 3 to 6 months of operating expenses and debt repayments while others may not be so fortunate.

Governments are moving into “whatever it takes mode”.

That is why we see the US Federal Reserve and the UK government taking drastic action to support the flow of credit. The US Fed cut interest rates to zero and announced a massive stimulus (around $ 1 trillion) to shield the economy. The aim now is to get the funds in the hands of those who need it most (the travel industry being one in dire need).

The UK Government has announced that it will guarantee £330 billion of bank loans to businesses to stop them from going bankrupt and said that they will go further if needed. Larger firms will be able to easily access low cost commercial loans directly through the Bank of England and small- and medium-sized businesses can borrow up to £5 million with no interest due for the first six months.

Other governments around the world are also preparing similar stimulus packages for their countries by accessing government emergency funds. The International Monetary Fund is prepared to lend $1 trillion to governments to get through this period.

This is very comforting.

When will normal life resume?

Some experts say it will take about 2 months to get the virus under control (looking to China as an example, as the Chinese slowly return to normal life) and others say that life would return to normal by July or August of this year.

Hence economists forecast the downturn to last about 6 months.

Is this market crash similar to the 2008 financial crisis?

No.

The 2008 financial crisis and recession was largely due to flaws in the banking system which almost bankrupted banks and as a result halted credit (remember the most important thing for the economy is to keep the debt machine going and and allow companies easy access to credit).

Covid-19 is an external shock, similar to a natural disaster and thanks to new regulations introduced in 2010, banks have healthy balance sheets (i.e., in good shape) to deal with this shock.

While the 2008 downturn lasted 18 months, the current downturn is expected to last around 6 months, assuming the number of cases peak in the next few months and abates by summer.

Why is this an opportunity for you?

For those who have been watching the market rally over the past decade and having FOMO, now is an opportune time to get in. There are some good businesses with strong fundamentals trading at 50% of their value due to the coronavirus crash.

Most businesses will be able to weather this storm and eventually return to normal operations.

Prior to the crash, corporate earnings in America have never been better and the US tax rate cut will continue to benefit companies each year.

If you decide to invest in the stock market, do not go all in at once. Its impossible to time any market bottom so I recommend investing incrementally over the next 12 weeks, spreading your bets so as to average out your price entry point.